What Do Healthy Michigan Plans Cover?

-

Oral exams (2 in 12 months)

-

Assessment (2 in 12 months)

-

Bitewing X-rays (1 in 12 months)

-

Full Mouth or Panoramic X-rays (1 in 5 years)

-

Other X-rays as needed

-

Teeth Cleaning (2 in 12 months)

-

Emergency Treatment of Dental Pain

-

Filling of Cavities

-

Sedative Filling

-

Extractions (simple and surgical)

-

Limited other oral surgery

-

I.V. sedation (when medically necessary)

-

General Anesthesia (when medically necessary)

-

Complete Denture (1 in 5 years)

If your dentist decides you need more dental services than those listed, those services may be covered if approved by Delta Dental. Some services are NOT covered.

Excluded Services:

-

Bite guards

-

Removal of healthy third molars (wisdom teeth)

-

Bridges, inlays and crowns (except for resin and stainless steel crowns listed above)

-

Implants

-

Cosmetic dentistry

-

Removable space maintainers

-

Services covered under a hospital, surgical/medical, or prescription drug program

-

Treatment of TMJ (TMJ is a problem that can cause pain in your jaw joint and can also cause pain in the muscles that control jaw movement.)

Be sure to ask your dentist if a service is covered before the service is done. You must pay for services that are not covered. HMP administered by Delta Dental does not limit its payment on services based on moral or religious grounds.

*There will be an out of pocket pay for any other additional procedures*

Original Medicare (Parts A & B)

Original Medicare (Parts A and B) does not include coverage for services like dental exams, cleanings, fillings, crowns, bridges, plates or dentures. There are some exceptions, such as when a hospital stay is involved, but otherwise you would have to pay out of pocket for any routine services.

Pay only a percentage

Depending on your insurance PPO company there is an out of pocket that may need to be paid. For example, if fillings are covered at 80%, you pay the remaining 20% of the cost. (You may be responsible for a deductible, as well as charges for non-covered services and amounts over the annual maximum dental services).

USA

- Payment for Services

- Dentist Selection

- Switching Dentists

- Specialty Care

- Waiting period

Delta Dental

PPO- Coinsurance

- Visit any licensed dentist, but save with in-network dentist

- Any time (no notification needed)

- Visit any licensed dentist

- Yes

DeltaCare

®- Set Co-Payments

- Must visit primary care dentist

- Online or via phone (will become effective the following month)

- Care provided by a specialist is coordinated through the selected primary care dentist

- No

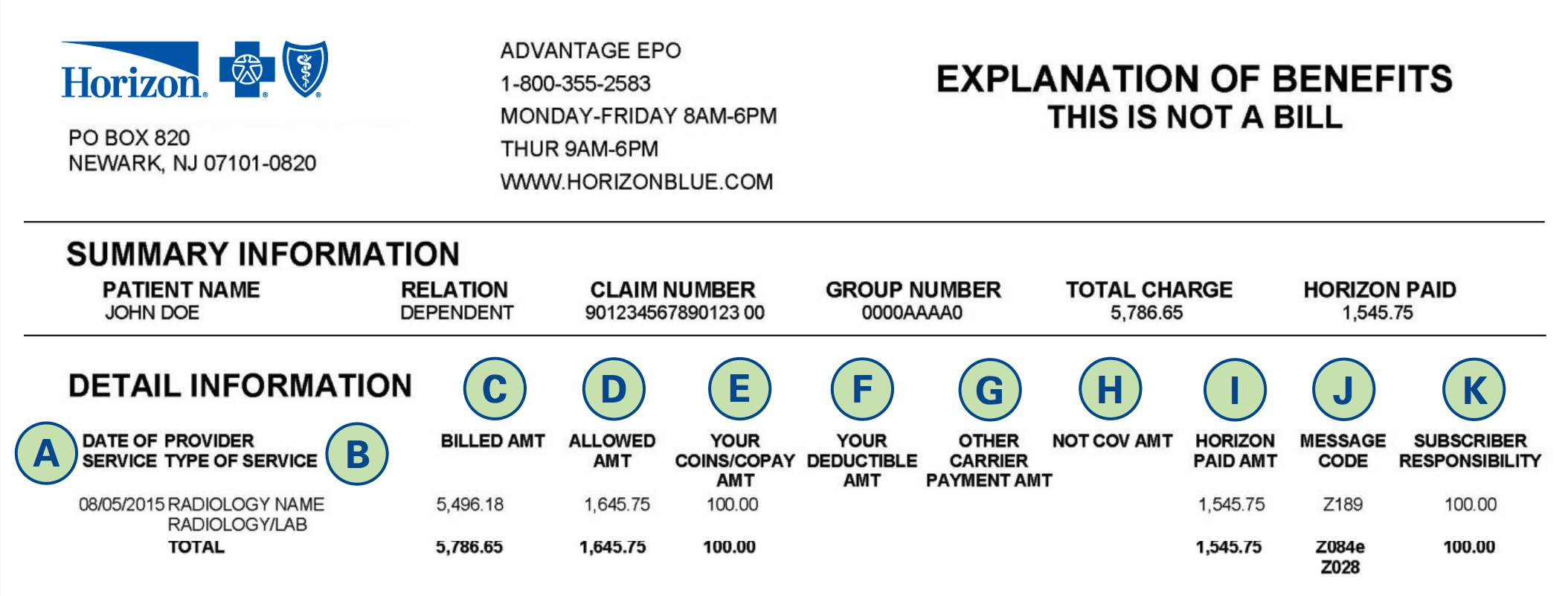

What Is an Explanation of Benefits (EOB) statement?

Your Explanation of Benefits (EOB) is a paper or electronic statement provided by your dental insurance company, which breaks down any dental treatments or services that you have received.

The EOB is different from a bill. It is sent to you after your dentist visit, and outlines your costs, the treatments that were covered under your dental plan, and treatments that may not have been covered and why.

What Other Savings Options are Available?

Aetna Dental Insurance is often a great option for preventative care, but it’s usually not ideal for dental implants. Fortunately, Aetna understands this, which is why they also offer Aetna Dental Savings Plans.

For about $110 a year, members gain access to discounts between 15% and 50% on a huge range of dental procedures (the specific discounts vary based on the type of procedure). Unlike dental insurance, savings plans cover a variety of cosmetic issues. They also cover dental problems you had before purchasing the plan, like missing teeth.

Plus, dental discounts plans have no waiting periods. If you’re missing a tooth right now, an Aetna discount plan can help you save immediately on dental implants and related care. Don’t let a lack of dental insurance coverage prevent you from the full, healthy smile you deserve!

How Much Do Implants Cost?

The average cost of an endosteal implant is $2,400. Mini-implants average around $1,500. However, costs can vary significantly based on the type of implant used, your overall oral health, the location of your dentist (rural practices are typically cheaper than ones in urban areas) and other factors.

Keep in mind that’s the cost for just one implant. Additional implants, as well as related procedures such as creating custom crowns and dentures, will increase the costs.

Does Aetna Dental Insurance Cover Dental Implants?

It can, although dental insurance isn’t always the best option for reducing dental implant costs.

Most dental insurance companies consider dental implants to be a cosmetic procedure, which isn’t covered by most policies. However, your Aetna policy may cover costs related to dentures, crowns or related procedures.

Additionally, dental insurance policies have annual limits, which typically range from $1,000 to $1,500.Even if your dental insurance covers dental implants, you’ll almost certainly reach the policy’s annual limit quickly.

Finally, dental insurance companies often limit treatment for pre-existing conditions. Almost no policies cover treatments for teeth which were missing before the policy was purchased. Waiting periods are also common for more advanced procedures like dental implants and crowns. You’ll likely have to wait at least six months before coverage begins. Waiting periods prevent folks from buying insurance, maxing out their benefits immediately and then simply dropping the policy.